Shifting Power and Strategic Autonomy

In global politics, perception shapes power, but China’s current strategy suggests more than perception management.

Its refusal to yield to U.S. tariff pressure marks a deliberate assertion of strategic autonomy. When Washington initiated steep tariffs under the Trump administration, many countries sought compromise through dialogue.

Beijing instead opted for reciprocity, matching every American tariff escalation in kind. This was not simply economic defiance; it was a signal that China would no longer accept an asymmetric global order dictated by Washington’s preferences.

China’s resistance to tariff pressure rests on preparation, diversification and domestic restructuring that began after the 2018 trade war.

Then, China reduced its export dependence on the U.S. and developed alternative markets through the Belt and Road Initiative (BRI) and regional frameworks.

While nearly one-fifth of its exports once went to the U.S., this share has steadily declined. At the same time, China’s exposure in GDP terms remains limited, indicating that even severe tariffs inflict manageable damage. Beijing’s confidence stems from the belief that the U.S. will also bear the costs, through higher prices, inflation and political discontent in a consumer-driven economy.

China has used the years since 2018 to fortify its economic base. Its export dependency on the U.S. has fallen by half, even as U.S. reliance on Chinese manufacturing quadrupled in the same period. Over 500 categories of products remain sourced almost exclusively from China, giving Beijing residual leverage.

Domestically, President Xi Jinping’s “Common Prosperity” campaign has sought to expand the middle class and rebalance growth toward domestic consumption. The long-term vision is an “internal circulation economy” that cushions external shocks and reduces vulnerability to Western sanctions or tariffs. Beijing’s message is clear: If global markets turn hostile, China will build and consume internally.

Economic Leverage and Technological Sovereignty

China’s structural strength lies in control of critical materials and manufacturing ecosystems. It dominates more than 70% of global rare earth mineral processing—a position that directly influences high-technology and defense supply chains. Through overseas investment and mine ownership in Latin America and Africa, Beijing ensures that, even when extraction happens abroad, operational control remains Chinese.

This gives China negotiating leverage in ways tariffs cannot offset. Moreover, its export subsidies, reduced lending rates, and growing control over mid-stream supply chains allow it to stabilize industries targeted by U.S. restrictions.

The United States still holds a technological advantage in semiconductor design and advanced chip architecture. Washington’s CHIPS Act and export bans on high-end tools aim to freeze China’s ascent in critical technologies.

In response, Beijing has accelerated indigenous R&D and foundry capability. Chinese firms such as Huawei are already developing alternatives to Western machinery and chipmaking processes once deemed irreplaceable. The direction is toward technological sovereignty—a decoupled but parallel innovation ecosystem.

China’s internal narrative frames the trade conflict as a struggle against Western containment, reminiscent of its “Century of Humiliation.” This framing serves to unify domestic sentiment and deflect economic frustration.

The message to the public is that hardship results not from domestic mismanagement but from external hostility. By emphasizing endurance and national pride, the Chinese Communist Party reinforces legitimacy even amid short-term economic disruption.

Global Realignments and Systemic Implications

The tariff war has also produced unintended diplomatic consequences. East Asian partners such as Japan and South Korea—traditional U.S. allies—are exploring deeper regional trade cooperation with China to mitigate economic volatility.

In Southeast Asia, nations like Vietnam, Malaysia and Cambodia, once courted as counterweights to Beijing, are strengthening engagement with China as a pragmatic hedge. In Europe, discomfort with Washington’s unilateral tariff policy is growing.

The European Commission’s outreach to Chinese leadership following recent tariff announcements signals a cautious balancing act—condemning protectionism while avoiding total alignment with U.S. strategy.

Meanwhile, China is bypassing U.S. restrictions by investing in Latin America and Mexico, routing exports indirectly through regional trade agreements like USMCA. Such adaptive behavior underscores the limits of tariff enforcement in a globalized production system.

The continuation of tariff escalation risks accelerating economic fragmentation. A divided global economy, one driven by U.S.-aligned supply chains and another centered around Chinese networks, appears increasingly plausible. For Washington, prolonged tariffs may erode competitiveness and invite political backlash.

For Beijing, sustained confrontation tests the limits of resilience and may entrench inefficiencies behind state protection. The broader danger lies in the normalization of economic coercion as statecraft. With trade weaponized and technology bifurcated, multilateral norms erode. Inflationary pressure, uncertainty in investment, and weakened global demand could become structural features of this emerging order.

The U.S.-China tariff confrontation is no longer about trade balances; it is about defining the rules of 21st century globalization. Each side seeks not co-existence but dominance in setting the standards, technologies and institutions that govern the global economy.

For the rest of the world, the challenge is to maintain agency, resist binary alignment, and preserve the stability of open markets. Diplomacy in this environment must focus on transparency, restraint and the reconstruction of limited cooperation frameworks—particularly on critical minerals, export controls, and supply-chain resilience.

In the contest between the world’s two largest economies, perception may initiate confrontation, but only strategic substance will determine which system ultimately shapes the future of global economic order.

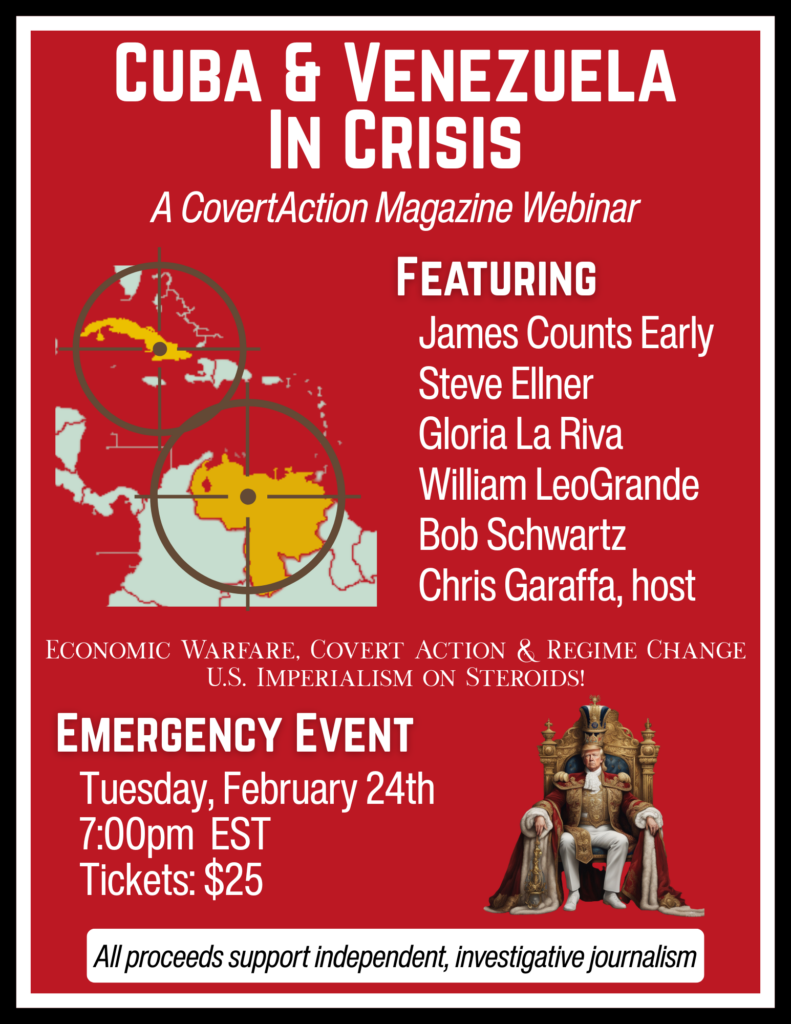

CovertAction Magazine is made possible by subscriptions, orders and donations from readers like you.

Blow the Whistle on U.S. Imperialism

Click the whistle and donate

When you donate to CovertAction Magazine, you are supporting investigative journalism. Your contributions go directly to supporting the development, production, editing, and dissemination of the Magazine.

CovertAction Magazine does not receive corporate or government sponsorship. Yet, we hold a steadfast commitment to providing compensation for writers, editorial and technical support. Your support helps facilitate this compensation as well as increase the caliber of this work.

Please make a donation by clicking on the donate logo above and enter the amount and your credit or debit card information.

CovertAction Institute, Inc. (CAI) is a 501(c)(3) non-profit organization and your gift is tax-deductible for federal income purposes. CAI’s tax-exempt ID number is 87-2461683.

We sincerely thank you for your support.

Disclaimer: The contents of this article are the sole responsibility of the author(s). CovertAction Institute, Inc. (CAI), including its Board of Directors (BD), Editorial Board (EB), Advisory Board (AB), staff, volunteers and its projects (including CovertAction Magazine) are not responsible for any inaccurate or incorrect statement in this article. This article also does not necessarily represent the views the BD, the EB, the AB, staff, volunteers, or any members of its projects.

Differing viewpoints: CAM publishes articles with differing viewpoints in an effort to nurture vibrant debate and thoughtful critical analysis. Feel free to comment on the articles in the comment section and/or send your letters to the Editors, which we will publish in the Letters column.

Copyrighted Material: This web site may contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. As a not-for-profit charitable organization incorporated in the State of New York, we are making such material available in an effort to advance the understanding of humanity’s problems and hopefully to help find solutions for those problems. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. You can read more about ‘fair use’ and US Copyright Law at the Legal Information Institute of Cornell Law School.

Republishing: CovertAction Magazine (CAM) grants permission to cross-post CAM articles on not-for-profit community internet sites as long as the source is acknowledged together with a hyperlink to the original CovertAction Magazine article. Also, kindly let us know at info@CovertActionMagazine.com. For publication of CAM articles in print or other forms including commercial internet sites, contact: info@CovertActionMagazine.com.

By using this site, you agree to these terms above.

About the Author

Prof. Kashif Hasan Khan is the Dean of the School of Graduate Studies and Head of the Department of Economics at Paragon International University in Phnom Penh, Cambodia.

Khan previously served as Associate Professor at Ala-Too International University in Bishkek, Kyrgyzstan, and has also held academic and consulting positions in Turkey, the Philippines, and with the Asian Development Bank in India.

His research focuses on economic corridors, de-dollarization, BRICS+ economies, and global economic governance, with an emphasis on the transformation of the international monetary system and the emerging multipolar economic order.

Prof. Khan has authored and co-edited several books with leading publishers and has published widely in reputable international journals.

More about his work can be found at www.kashifhasan.com or by contacting him at rfellow8@gmail.com.