The U.S. government has increasingly become a brokerage[1] platform for elite business capital accumulation goals camouflaged under a national security agenda.

Anyone who has read my latest book, U.S.-Russian Commercial Relations 1763-1933: Origins of Russophobia (New Delhi: Atlantic, 2025)—see a review in CovertAction Magazine here), would recognize that the U.S. government’s role as facilitator for its grandest firms is nothing new—it was until recently, however, inconspicuous. President Trump is the first U.S. president to brazenly use his executive powers to act as the Dealmaker-in-Chief for the benefit of elite U.S. corporations.[2]

Once a vocal champion of liberal capitalism and profit-driven, supply-and-demand mechanisms, the U.S.—under one of the world’s (self-proclaimed) greatest businessmen—is now following China, Russia and Brazil in a wave of state purchases of key firms.

This would not be so disturbing if our elite firms were concerned with the American public, our quality of life, the environment or even the health of the U.S. economy (beyond how it affects their profitability), but they are not—and they are not really supposed to be.

“You can have a great concentration of wealth, or democracy. Not both.”

Corporations do not factor patriotism into their spreadsheets and are no more loyal to their countries of origin than to their states of incorporation.[3] The U.S. federal government (like state incorporation laws), to them, is just a bureaucratic structure which they exploit to promote their capital accumulation goals and shareholders’ private financial interests.

In 2024 alone, the U.S. business lobby spent $4.5 billion[4] on making sure U.S. policy and legislation served their agendas. Because our supposedly “exceptional American system” places congresspeople on a constant fundraising treadmill where they need millions ($2-11 million[5]) to win and remain in office, it makes them dependent on constant competitive fundraising and inherently reassigns their loyalties from “We the People” to those in our society with the largest coffers—elite corporations and their affluent owners. (This flaw should be addressed through a Constitutional Amendment but corporations will never allow it.)

As corporate wealth and consolidation have increased, the power of corporations to influence our government has expanded exponentially. Far outpacing overall U.S. citizen wealth, corporate wealth has been driven by low tax rates, massive government subsidies, weak antitrust enforcement, massive lay-offs, increased mergers and acquisitions,[6] and widening pay gaps—the same laws and regulations they won through lobbying. Currently, the top 1% of U.S. businesspeople has accumulated between 30-40% of total wealth, leaving the bottom 50% of citizens with less than 3%.[7]

As Justice Louis Brandeis has allegedly said, “You can have a great concentration of wealth or you can have democracy. You can’t have both.”[8] U.S. democracy has been “one dollar = one vote” for a long time.

The Trump administration is strengthening the relationship between corporations and government by taking direct ownership stakes in private companies. While historically anathema to U.S. capitalist ideals, the current administration is increasingly embracing a more active role in the private sector.

With more than $10 billion in taxpayer funds now invested in elite firms, Trump has transferred public money directly into the pockets of some of America’s richest corporations (U.S. and Canadian).

This policy puts the American public further at risk for corporate financial activities than ever before.

Feeding the Hand That Bit You[9]

The U.S. government claims that it is planning to lessen dependence on overseas chip manufacturing, secure a domestic supply of critical chips for defense and technology, maintain the lead in cutting-edge areas like artificial intelligence (AI), foster collaboration between the government and key U.S. companies by using existing CHIPS Act[10] grants and other federal funds for corporate incentives.[11]

That might sound great if you are too young to remember that, just a few decades ago, our corporations fled the U.S. en masse for the cheap labor markets of Asia and elsewhere, abandoning U.S. workers, their towns and cities. The transfer of U.S. manufacturing overseas profoundly impacted many U.S. cities and regions, particularly in the Rust Belt and parts of the Southeast and New England, where mass job losses led to economic decline. Communities like Baltimore, Buffalo, Chicago, Cincinnati, Cleveland, Detroit, Milwaukee, Philadelphia, Pittsburgh, Rochester and St. Louis were devastated when U.S. firms vacated these cities, leaving declining tax revenues, deteriorating infrastructure, and abandoned buildings—and they still have not fully recovered.

How did China become the U.S.’s greatest competitor?

After President Nixon’s 1972 visit to China, U.S. corporations began transferring factories there to take advantage of the cheap labor market where the average urban Chinese worker’s annual salary was 576 yuan in 1977, equivalent to just $384 USD.[12] At the same time, the median U.S. household income was between $13,570 and $16,010.[13]

Neutron Jack

Jack Welch (1935-2020), the former chairman and CEO of General Electric (GE), is known for the U.S. business philosophy that went viral during the 1980s that prioritizes shareholder value and global competitiveness over corporate loyalty to a specific country or domestic job preservation. His purely profit-driven methodology drove the offshoring of American jobs to maximize profits.[14]

“Ideally,” Welch was quoted as saying, “you’d have every plant you own on a barge to move with currencies and changes in the economy.”

During his tenure as CEO of GE from 1981 to 2001, Welch implemented policies that led to massive job cuts and the transfer of U.S. manufacturing to cheap overseas locations. He slashed GE’s U.S. workforce by half (about 160,000 jobs) while nearly doubling the company’s foreign workforce for a fraction (about 2.4%[15]) of U.S. salaries. Welch’s “downsizing” and cost-cutting measures earned him the nickname “Neutron Jack” (after the bomb that kills people but leaves buildings intact).

A proponent of “shareholder capitalism,” Welch held that a corporation’s purpose is to maximize short-term shareholder profits above all other stakeholders (employees, communities, etc.) and he promoted a corporate model that sought the cheapest labor and most favorable economic conditions on the global market, rather than on making sure the country and the people which made GE a global behemoth continued to share in its success.

Former U.S. Secretary of Labor Robert Reich said this about Welch:[16]

“JACK WELSH [sic] became the most admired CEO in America — at least in the business press, on Wall Street, and within rarified precincts like Harvard Business School.

His reign epitomized a chain reaction that started in the 1980s, when ‘corporate raiders’ mounted hostile takeovers of corporations, financed by risky bonds. The raiders made fortunes, Wall Street became the most powerful force in the economy, and CEOs began to devote themselves entirely and obsessively to maximizing the short-term value of shares of stock — whatever it took.

Before then, it was assumed that large corporations had responsibilities to all their ‘stakeholders’— not just their shareholders, but also their employees, the communities where their operations were located, their customers, and the public at large.”[17]

For decades, the U.S. government allowed (and is still allowing) the flight of U.S. businesses abroad to the detriment of our cities, communities, national defense and economy without allowing any real public discussion aimed at ameliorating the destruction these corporations cause to the fabric of our society, our domestic economic system, and the economic and social systems of the foreign nations they exploit.

An example of a major U.S. company profiting from turning over its business to China is IBM’s 2005 sale of its personal computer business, including the ThinkPad laptop, to Chinese computer maker Lenovo for which IBM received $1.25 billion in cash and an 18.9% stake in China’s Lenovo.[18] In 2014, IBM also sold its x86 server business to Lenovo for another $2.1 billion, again involving cash and stock.

In 2015, the Commonwealth of Massachusetts awarded IBM $2.5 million in state investment tax credits to establish its IBM Watson Health headquarters in Cambridge. The tax breaks were part of an economic development package to create 500 new jobs, with an expected private investment of $51 million.

By 2022, IBM had sold most of Watson Health’s data assets, which were spun off into a new company called Merative.[19] Merative’s headquarters are in Ann Arbor, Michigan. They used to have a presence in Cambridge, Massachusetts, at 179 Sidney Street, but that location is now listed as permanently closed.[20]

That is how incentives work.

Trump Administration’s Growing Portfolio

The U.S. government’s recent acquisitions include a 10% stake in semiconductor giant Intel Corp., a 15% stake in rare-earth producer MP Materials, a 10% stake in Lithium Americas Corp., a 10% stake in Trilogy Metals Inc., and a “golden share” in US Steel Corporation.[21]

The Department of Defense (DoD) acquired a stake representing about 15% of all shares in MP Materials, making it potentially the company’s largest shareholder, supposedly to counter China’s dominance in the global rare-earth market. MP Materials operates the only fully integrated rare-earth mining and processing facility in the U.S.

The U.S. Department of Energy (DoE), now holds a 5% equity stake in Canadian Lithium Americas (LAC) and a parallel 5% economic interest in the Thacker Pass mine’s joint venture with General Motors (GM), acquired as part of a restructured 24-year $2.26 billion federal loan won in 2024.[22]

According to Bloomberg, “The U.S. government plans to take more equity stakes in critical minerals companies, a White House official said [on December 6], stating the new policy [is] necessary to counter China’s dominance in the raw materials used in everything from semiconductors to MRI machines.”[23]

Among other deals are a $670 million stake in magnet producer Vulcan Elements Inc. and a $35.6 million stake (10%) in Canadian minerals explorer Trilogy Metals Inc.

The strategy of investing taxpayer dollars in companies deemed essential to national security comes as U.S. reliance on China for the crucial materials has become a flash point in the trade war.[24]

Trump’s deals, however, ignore that one of the major sources of China’s modern economic growth has been Western companies’ massive foreign investment there to exploit low-cost labor of scale and slack industrial and environmental policies.

How China Became the “World’s Factory”

After Nixon’s 1972 visit, China transformed itself from a radical opponent of capitalist ideology to one of history’s greatest platforms for generating profits for Western firms. U.S. companies alone have invested hundreds of billions of dollars in China since its opening in the late 1970s, with the stock of U.S. direct investment reaching $126.9 billion in 2023 (a 3.8% increase from 2022), concentrated in manufacturing, trade, finance and insurance.[25]

Offering monetary incentives and additional tax breaks to the firms which abandoned the U.S. for China’s low-cost labor and slack industrial and environmental policies will only provide these firms broader power over the U.S. economy. Every “key” firm can now claim to want to leave the U.S. for cheaper labor markets or less regulatory control unless they are provided monetary incentives—not unlike the federal system where states have had to compete for corporate income by offering tax breaks, incentives and favorable tax structures (like no corporate tax or worldwide combined reporting) to attract businesses, leading to a “race to the bottom” in state corporate tax rates.

This competition has driven states to lower corporate income tax (CIT) rates and change local laws to favor large corporations, negatively impacting state budgets and fairness for local businesses and employees. Moreover, once established, the incentives will only grow and each year we will be held captive to firms’ increasing demands, especially those that are ‘too big to fail.’

Nvidia’s Sale of Strategic H200 Taiwan-Made Chips to China

On December 8, The Wall Street Journal announced that President Trump would approve Nvidia’s sale of its H200 chips to China for an undisclosed amount.[26] The deal also provided for a 25% cut for the U.S. government in an unusual agreement with a private company.[27] The move followed a series of meetings between President Trump and Nvidia Chief Executive Jensen Huang.

Despite the fact that this critical AI technology has the potential to help China militarily and economically, the Trump administration granted the world’s #1 most valuable company, Nvidia, permission to sell its second-most-powerful chip to China. The approval is an abrupt about-face from previous policy which placed restrictions on Chinese companies’ access to U.S. technology.

In August, Nvidia Chief Financial Officer Colette Kress said that the company could ship between $2 billion and $5 billion-worth of chips to China per quarter, which could increase. This means Nvidia’s Taiwanese-made chip sales to China alone would be between $8 billion and $20 billion a year—to start.

How this could help U.S. employment or domestic manufacturing remains unexplained. Also left unexplained was what the 25% cut for the U.S. government, which would translate to between $2 billion and $5 billion per annum, would be used for.

Trump said the government would allow similar exports from Advanced Micro Devices as well as Intel.[28]

U.S. Government Ownership Stake in Intel

On August 22, 2025, the U.S. government purchased a 10% stake in Intel, the computer chip designer and fabricator. The move has its roots in the Biden administration’s 2022 CHIPS and Science Act which, among other things, encouraged companies to make chips in the U.S. by setting aside $53 billion in incentives for manufacturing, research and development.

Of that sum, $39 billion would be allocated as subsidies for building new facilities—effectively using U.S. tax funds to bribe U.S. firms to maintain or return their manufacturing facilities to U.S. soil. Whether it is a one-time bribe or will expand into yearly or quarterly “incentives” has not been publicly discussed.

During the pandemic, the U.S. government claimed it would lure U.S. manufacturing companies of those parts out of cheap-labor Asian nations and back to the U.S. with taxpayer money. Yet there is no mention of Nvidia relocating its manufacture of the H200 chip from Taiwan to the U.S.

While the rationalization for the investment is the increasingly critical nature of Intel’s products to national security for their use in aerospace and weaponry, telecommunications, automotives and medicine, Trump’s approval of the sale of Nvidia’s strategic chips to China negates that defense.

Foreign Policy Is Now “Commercial Diplomacy”

Foreign policy under the Trump administration has also undergone a radical public shift. “The United States will prioritize commercial diplomacy, to strengthen our own economy and industries…” says the National Security Strategy released from the White House last November. Instead of being a hidden agenda behind traditional diplomacy, the Trump White House has acknowledged that the U.S. will now openly pursue “commercial diplomacy.”

The official public version of “commercial diplomacy” is to advance national interests, essentially making economic strength a key part of soft power and global influence, moving beyond traditional military or political approaches. The administration’s focus on corporate demands, however, ignores the U.S. public and its needs for healthcare reform, affordable education, the social security funding crisis and numerous other issues.

Representation Without Taxation

“No taxation without representation” was a rallying cry during the American Revolution, protesting Great Britain’s taxation of its American colonies without allowing meaningful representation of their interests or consent to the laws. Today it describes the circumstances where corporations pay much less tax than the U.S. population but enjoy greater government representation for their capital accumulation goals and laws in their favor.

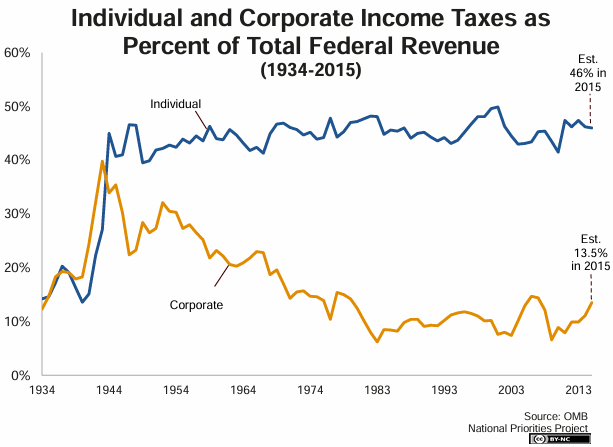

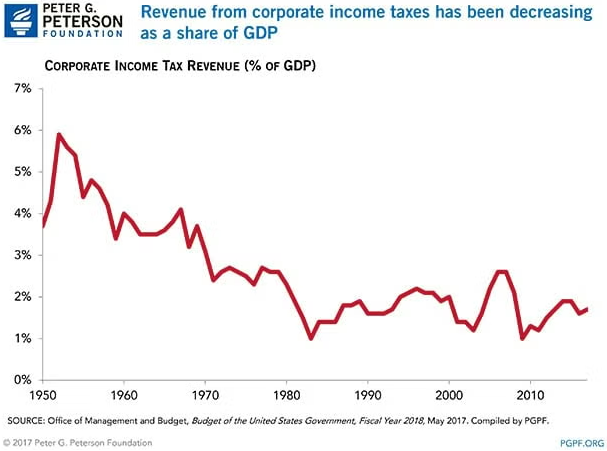

In the U.S., individual income taxes are the largest federal revenue source, about 10-10.5% of GDP (2022), while corporate income taxes are currently 1.6-1.7% (2021-2023). Total federal revenue hovers around 17-19% of GDP, with payroll taxes also a major component, making individual income tax the primary contributor among income taxes.

In 2024, individual income tax revenues are approximately 8.4% of GDP, while corporate income tax revenues were an estimated 1.8% of GDP. For 2025, individual income tax revenues are projected to be around 8.8% of GDP, and corporate income tax revenues are forecast to decline slightly to approximately 1.6% of GDP.[29]

It is no wonder the wealth gap is widening.

During Fiscal Year 2024, the U.S. federal government collected approximately $2.4 trillion in individual income taxes. Meanwhile, approximately $530 billion in federal corporate income taxes were collected for the same year.[30]

Declared FY 2024 Corporate Profits After Taxes (CP) were around $3.7 trillion for the 4th quarter, $3.4 trillion for Q3, $3.5 trillion for Q2, and $3.26 trillion for Q1, adding up to $13.86 trillion corporate profits after taxes.

Embassy Deal Teams

Formally launched in February 2020, the U.S. State Department’s “Embassy Deal Teams…bring together the collective programs, resources, and expertise of the U.S. government to support U.S. companies. This multi-agency collaboration promotes…deals which have delivered billions of dollars for U.S. companies.”[31]

The U.S. government’s role in assisting U.S. firms’ business objectives now includes the following tasks paid for by U.S. taxpayers—instead of the businesses which benefit from it:

- Information Gathering and Dissemination (Intelligence): Commercial diplomats collect and share critical market intelligence with businesses in their home country providing information on the foreign country’s rules, regulations, cultural nuances and market opportunities.

- Establishing networks with local business people, government officials, potential partners, distributors and investors, facilitating buyer-seller meetings.

- U.S. commercial diplomats provide active advocacy on behalf of U.S. businesses and industries to ensure “fair” treatment and a “level playing field” in foreign markets, reducing or eliminating trade barriers, such as non-tariff barriers or “burdensome” regulations.

- Engaging in direct advocacy and lobbying of the host government to change domestic economic policies that impact international commerce.

- Promotion and marketing campaigns.

- Engaging in image-building campaigns to attract foreign direct investment (FDI).

- Legal problem-solving and dispute resolution of conflicts that arise during international transactions.

- Providing legal support such as mediation/arbitration in cases of contract disputes, intellectual property violations, or other business conflicts.

The State Department’s diplomatic programs, including commercial/economic work, received about $10.4 billion for Fiscal Year 2024, as part of the larger International Affairs budget which is about $78 billion.[32]

The Emerging “Platform State”

The U.S. is leading the world into an era of “commercial diplomacy,” and it is directly challenging institutions and policies built in the post-World War II era designed to maintain peace and economic stability such as global trade policies and the United Nations, which could also serve as monitoring platforms for unilateral U.S. commercial policy and its motivations. In their place, tariffs, companies and trade deals are being used for international tradecraft.[33]

British investment firm Baillie Gifford explains:

“The US as an emerging ‘platform state’

One of Baillie Gifford’s private company holdings, autonomous drone company Zipline, is the clearest and most recent example.

Under its new State Department agreement, the Trump administration is funding $150m of Zipline equipment and infrastructure in Rwanda, Ghana, Nigeria, Kenya and Côte d’Ivoire, after having closed the US Agency for International Development (USAID).

The State Department releases funds only when specific delivery targets are met. After that, African governments pay Zipline for each delivery they receive in a pay-for-performance model that could unlock $400m if successful.

A similar model is emerging in the technology sector.

Nvidia and Advanced Micro Devices (AMD) have agreed to pay 15 per cent of their China AI-chip revenue to the US government, via the Commerce Department, in exchange for the export licenses required to sell restricted products abroad.

This arrangement is a commercial permission with a fee, distinct from bans or subsidies. Tariffs sit alongside these licensing rules, the idea being to steer supply chains by raising costs for strategic rivals and giving preferential access to selected partners.

Under the current administration, the US appears to be evolving from a donor state to what you could call a platform state—a government that procures services from private operators rather than running programmes directly and uses tariffs and export rules to influence where those operators invest.

Instead of wiring grants to the United Nations or USAID, it buys capacity from logistics and technology firms. Instead of prohibiting AI chip sales to China outright, it monetises the scarcity created by export controls. Tariffs and revenue-sharing frameworks push and pull factories, supply chains and capital toward preferred jurisdictions.

In practice, this is commercial diplomacy: foreign policy carried out through corporate capability.”[34] (All spellings as originally published.)

Continued Subsidies

While Elon Musk’s so-called Department of Government Efficiency (DOGE) decried excessive government spending and vowed to cut waste, direct federal spending on corporate welfare (subsidies) continue at around $181 billion annually, with an additional $154-188 billion in corporate tax savings through loopholes and tax breaks in 2024 alone. Recent legislation in 2025 included nearly $1 trillion in new corporate tax breaks for the following decade.[35]

The U.S. government provides the fossil fuel industry alone with an estimated $34.8 billion annually in subsidies and tax breaks. It also “gifts” our natural resources on public lands to corporations at below-market rates for drilling, logging, and mining. In September 2025, reports tallied that recent legislation added nearly $40 billion in additional federal subsidies for oil, gas and coal over the next decade.

These figures do not even include the costs incurred by environmental damage and climate change (which Trump calls a “hoax”). Tallying these unaccounted costs for the fossil fuel industry alone drives the cost to taxpayers into the hundreds of billions annually, with one 2022 estimate at $760 billion when including societal costs.[36]

It is one thing for a nation to manipulate its own domestic system, but quite another to allow a financially and militarily powerful nation to distort the global market through government-sponsored, corporate-directed, unfair practices.

No International Organizational Structure to Monitor and Regulate

Without any international organizational structure to monitor and regulate the activities of a financially and militarily powerful nation determined to fortify the global market position of those firms it has a relationship with, the U.S. is challenging its own founding principles of democracy and “checks and balances.”[37] This “my-way-or-the-highway” attitude of the U.S. administration to the rest of the world is sorely out of the American national character cultivated by decades of propaganda.

While the extraterritorial activities of multinational corporations are (still) not monitored for their economic and social impacts when they operate in foreign countries, a proposed UN treaty aims for direct corporate responsibility for human rights.

That proposed UN treaty (by Ecuador with support from other small countries) would establish direct, legally binding human rights obligations for transnational corporations. Adopted by the UN Human Rights Council on June 26, 2014, Resolution 26/9, known as the Business and Human Rights (BHR) Treaty, has suffered significant opposition from developed countries where the MNCs that would be monitored exercise significant influence.

For the past ten years, the UN’s BHR Treaty has sought to address the challenge of regulating powerful multinational corporations operating internationally, to develop a legally binding instrument on business and human rights with little success.

One of the reasons for that failure is the fact that powerful business voices have been allowed to participate in the negotiation process.

An April 2025 report from the Centre for Human Rights Erlangen-Nürnberg (CHREN) states the following:

“[The CHREN] report looks at the role of corporations in the negotiations of the BHR Treaty but it is nevertheless important to acknowledge that corporations are not the main negotiators of the Treaty. Formally, they do not have the power to enter into international treaties and bear obligations under international law. States are the primary subjects of international law, which means that they are the ones with rights and obligations, and the corresponding ability to enter international treaties. Corporations, on the other hand, lack independent legal personality and cannot formally be held accountable under international law.[38]

Despite this, corporations play a significant economic and political role in international relations today. They shape globalisation, trade, supply chains, and have important environmental and human rights impacts. This raises concerns about the limits of a state-centred international legal system. Corporations already influence international law, particularly in economic and trade matters. However, they have also been associated with major human rights violations. This has reinforced calls to hold them accountable, including under rules of international law. While corporations currently do not bear direct international human rights obligations, their growing influence has sparked debate over whether they should. Supporters of corporate accountability argue that subjecting corporations to international law would help close regulatory gaps, prevent human rights violations and create legal consistency. Relying solely on state-based mechanisms is seen as insufficient, as some governments fail to protect human rights due to their economic dependence on corporate investments. Legal reforms would be needed to impose binding obligations on corporations, ensuring compliance with human rights and environmental standards regardless of national legislation.”[39]

While CHREN erroneously states that, “Corporations…lack independent legal personality and cannot formally be held accountable under international law,”[40] it has allowed them, through powerful global business networks which advocate corporate interests, to participate in the treaty negotiation process. Those “main business networks,” such as the Geneva-based International Organisation of Employers (IOE), which claims to be the largest global network of the private sector, the United States Council for International Business (USCIB), which represents major global companies whose collective economic assets are in the trillions of dollars, and the International Chamber of Commerce (ICC), whose dispute resolution services have approximately US$354 billion in pending cases—when the U.N.’s total annual budget for 2025 was just $3.7 billion.

Accordingly, these “business networks” oppose the current BHR Treaty draft due to concerns over feasibility, legal implications, and financial consequences and, instead, advocate for voluntary approaches.[41]

But there is more than human rights at stake and it is something no one seems to be stating.

Power Plays to Gain Unfair Advantage over Markets and Resources

The dangerous feature of commercial diplomacy, especially one driven by a commercially powerful country, is that there is never a shortage of political and ideological reasons to penalize a foreign nation and its grandest firms, especially if some of those firms pose a competitive challenge to the elite firms of the enforcing nation.

Moreover, there exists no international organizational infrastructure to monitor and regulate the punitive commercial measures enacted by various states against another to ensure that those measures are for the reasons stated and not to disguise a power play to gain an unfair commercial advantage of a market or resource.

There are just too many instances in history where complete information regarding events did not emerge until decades later. There needs to exist an international tribunal dedicated to monitoring economic sanctions—not just the U.S. Treasury—to ensure that true justice is being pursued and not just “commercial diplomacy” aimed at ensuring that “America [remains] First.”

The U.S. government’s insistence that it act as “global policeman”—while eschewing international organizations already in existence for that very role—not only deflects attention and resources from domestic issues but embroils us in political and commercial intrigues which will rightly challenge our professed role as champion of established “free market” capitalism and unfettered competition.

In business, brokerage refers to the service of acting as an intermediary connecting buyers and sellers to facilitate commercial transactions for a fee or commission, with brokerage firms providing platforms, research and execution for clients. ↑

The characterization of Donald Trump as a “dealmaker” stems from his career as a real estate developer and businessman, a persona he actively cultivated, particularly through his 1987 book, Trump: The Art of the Deal. In that book, he famously stated, “Deals are my art form. Other people paint beautifully on canvas or write wonderful poetry. I like making deals, preferably big deals. That’s how I get my kicks.” (Antonia Hitchens, “Donald Trump’s Tariff Dealmaker-in-Chief: How Howard Lutnick, the Secretary of Commerce, plans to transform government into a money-making enterprise.” The New Yorker, July 21, 2025. ↑

The state of incorporation is the U.S. state where a company formally files its legal formation documents (like Articles of Incorporation) to become a recognized corporate entity, establishing which state’s laws (governance, taxes and reporting) will govern it, though this can differ from the state where the business physically operates (its home state or domicile state). Many companies choose states like Delaware for favorable corporate laws, while others incorporate in their primary operating state for simplicity, a choice depending on costs, goals and legal benefits. ↑

“Federal Lobbying Spending Reached New High in 2024, Bloomberg Government’s 10th Annual Top-Performing Lobbying Firms Report Finds,” Bloomberg, April 15, 2025. ↑

Amisa Ratliff, “The Congressional Fundraising Treadmill: Six Numbers to Know from New Campaign Finance Filings, July-September 2022” IssueOne.org, October 20, 2022. ↑

https://www.troweprice.com/institutional/nz/en/insights/articles/2025/q4/how-us-firms-became-profit-giants-and-why-it-may-not-last-apac.html#:~:text=To%20summarize:%20The%20digital%20age,the%20present%20(Figure%204). ↑

“Share of Net Worth Held by the Top 1% (99th to 100th Wealth Percentiles) — Series WFRBST01134.” FRED, Federal Reserve Bank of St. Louis (Source: Board of Governors of the Federal Reserve System); “Distributional Financial Accounts — Overview,” Board of Governors of the Federal Reserve System. ↑

Dick Dowdell, “‘You can have a great concentration of wealth or you can have democracy. You can’t have both.’ How Citizens United v. FEC turned Justice Brandeis’ warning into a structural crisis,” Medium, December 1, 2025. ↑

A twist on the idiom “biting the hand that feeds you,” “feeding the hand that bit you” implies rewarding or helping someone who has been cruel or ungrateful to you. ↑

The CHIPS and Science Act of 2022 is a U.S. law meant to boost domestic semiconductor research, development and manufacturing through $52.7 billion in subsidies and tax credits, aiming to strengthen supply chains, create jobs, and increase U.S. competitiveness against China. It is also directing tax funds to broader science/tech research like AI and quantum computing. Signed into law by President Joe Biden in August 2022, it provides incentives for companies like Intel, TSMC and Samsung to build new fabrication plants in the U.S., alongside investments in workforce training and R&D for future technologies. ↑

https://www.pbs.org/newshour/politics/what-economic-and-policy-experts-think-about-the-u-s-governments-stake-in-intel#:~:text=The%20Trump%20administration’s%20unusual%20step,nation’s%20economy%20down%20with% 20it. ↑

Geremie Barmé, “Renminbi 人民币”. The China Story, April 19, 2025. ↑

https://www.census.gov/library/publications/1978/demo/p60-117.html#:~:text=The%20median%20money% 20income%20of,change%20from%20the%201976%20median. ↑

https://robertreich.substack.com/p/jack-welch-and-the-end-of-stakeholder ↑

$384/yr. (Chinese salary) is 2.4% of $16 000/yr. (U.S. salary). ↑

Robert Reich, “Jack Welch and the End of Stakeholder Capitalism,” Chapter 5 of The Common Good, September 1, 2023. ↑

https://robertreich.substack.com/p/jack-welch-and-the-end-of-stakeholder ↑

https://www.forbes.com/sites/timbajarin/2025/05/06/the-20th-anniversary-of-lenovo-ibm-deal-that-reshaped-the-pc-industry/ ↑

https://masslib.dspace7.dspace-express.com/server/api/core/bitstreams/dea96588-00f7-45ea-916a-24c41e7844a2/ content ↑

https://www.merative.com/contact#:~:text=Address:,Ann%20Arbor%2C%20Michigan%2048108 ↑

https://finance.yahoo.com/news/trump-administration-now-holds-stakes-023008085.html ↑

https://www.energy.gov/articles/department-energy-restructures-lithium-americas-deal-protect-taxpayers-and-onshore; https://lithiumamericas.com/news/news-details/2024/Lithium-Americas-Closes-2.26-Billion-U.S.-DOE-ATVM-Loan/default.aspx ↑

Ari Natter, “US Plans More Stakes in Minerals Companies, Trump Official Says,” Bloomberg, December 4, 2025. ↑

Ibid. ↑

U.S. Embassy & Consulates in China, “U.S. Relations with China—Bilateral Relations Fact Sheet,” February 13, 2025, https://china.usembassy-china.org.cn/u-s-relations-with-china/#:~:text=U.S.%20foreign %20direct %20investment%20(FDI,down%206.2%20percent%20from%202022. ↑

Amrith Ramkumar and Robbie Whelan, “Trump Says U.S. Will Allow Nvidia H200 Chip Sales to China, Get 25% Cut,” The Wall Street Journal, December 8, 2025. ↑

Idem. ↑

Idem. ↑

Congressional Budget Office, “The Budget and Economic Outlook: 2025 to 2035.” https://www.cbo.gov/publication/61172#:~:text=Revenues%20total%20$5.2%20trillion%2C%20or,reaching%2018.3%20percent%20in%202035.&text=The%20deficit%20for%202025%20is,not%20subject%20to%20the%20shifts. ↑

According to data from the Bureau of the Fiscal Service, Statista, and USAFacts. ↑

https://www.state.gov/deal-teams#:~:text=Embassy%20Deal%20Teams%20Coordinate%20Interagency, supported%20millions%20of%20U.S.%20jobs. ↑

https://www.pgpf.org/article/how-much-does-the-government-spend-on-international-affairs/ ↑

https://www.bailliegifford.com/en/uk/individual-investors/insights/ic-article/2025-q4-us-perspectives-commercial-diplomacy-10059554/ ↑

Ben James, “Are we in an era of commercial diplomacy?” Baillie Gifford, December 2025. ↑

https://www.cato.org/policy-analysis/corporate-welfare-federal-budget-0#:~:text=This%20study%20tallies%20 corporate%20welfare,%EF%B9%A2; https://www.americanprogress.org/article/congress-tax-bill-is-selling-out-americas-public-lands-and-waters/#:~:t ext=Cutting%20special%20deals%20for%20fossil,including%20conservation%20and%20outdoor%20recreation. ↑

Idem.; https://www.wired.com/story/us-taxpayers-will-pay-billions-in-new-fossil-fuel-subsidies-thanks-to-the-big-beautiful-bill/#:~:text=A%20new%20report%20finds%20the,existing%20support%20for%20fossil%20fuels. ↑

Checks and balances in government is a system where each of the three branches (legislative, executive, judicial) has powers to limit or oversee the other branches, preventing any single branch from becoming too dominant, ensuring a separation of powers, and protecting against tyranny through shared authority and accountability. ↑

This is an erroneous statement. ↑

https://media.business-humanrights.org/media/documents/Corporations_in_the_UN_BHR_Treaty_Negotiations_ Final_Report_CHREN_April_2025.pdf ↑

Corporations do possess an independent legal personality (separate legal entity), a fundamental concept in law that treats them as artificial persons with rights and duties distinct from their owners, allowing them to own property, sue, be sued, and enter contracts. This legal fiction, evolving from Roman law, is crucial for commerce, enabling limited liability and simplifying complex business operations, even though some debate exists, especially regarding constitutional rights. Why CHREN would claim otherwise is troubling. ↑

https://media.business-humanrights.org/media/documents/Corporations_in_the_UN_BHR_Treaty_Negotiations_ Final_Report_CHREN_April_2025.pdf ↑

CovertAction Magazine is made possible by subscriptions, orders and donations from readers like you.

Blow the Whistle on U.S. Imperialism

Click the whistle and donate

When you donate to CovertAction Magazine, you are supporting investigative journalism. Your contributions go directly to supporting the development, production, editing, and dissemination of the Magazine.

CovertAction Magazine does not receive corporate or government sponsorship. Yet, we hold a steadfast commitment to providing compensation for writers, editorial and technical support. Your support helps facilitate this compensation as well as increase the caliber of this work.

Please make a donation by clicking on the donate logo above and enter the amount and your credit or debit card information.

CovertAction Institute, Inc. (CAI) is a 501(c)(3) non-profit organization and your gift is tax-deductible for federal income purposes. CAI’s tax-exempt ID number is 87-2461683.

We sincerely thank you for your support.

Disclaimer: The contents of this article are the sole responsibility of the author(s). CovertAction Institute, Inc. (CAI), including its Board of Directors (BD), Editorial Board (EB), Advisory Board (AB), staff, volunteers and its projects (including CovertAction Magazine) are not responsible for any inaccurate or incorrect statement in this article. This article also does not necessarily represent the views the BD, the EB, the AB, staff, volunteers, or any members of its projects.

Differing viewpoints: CAM publishes articles with differing viewpoints in an effort to nurture vibrant debate and thoughtful critical analysis. Feel free to comment on the articles in the comment section and/or send your letters to the Editors, which we will publish in the Letters column.

Copyrighted Material: This web site may contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. As a not-for-profit charitable organization incorporated in the State of New York, we are making such material available in an effort to advance the understanding of humanity’s problems and hopefully to help find solutions for those problems. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. You can read more about ‘fair use’ and US Copyright Law at the Legal Information Institute of Cornell Law School.

Republishing: CovertAction Magazine (CAM) grants permission to cross-post CAM articles on not-for-profit community internet sites as long as the source is acknowledged together with a hyperlink to the original CovertAction Magazine article. Also, kindly let us know at info@CovertActionMagazine.com. For publication of CAM articles in print or other forms including commercial internet sites, contact: info@CovertActionMagazine.com.

By using this site, you agree to these terms above.

About the Author

Gabriela Gavrilov’s most recent work is U.S.-Russian Commercial Relations 1763-1933: Origins of Russophobia (Atlantic, 2025). She is also author of the historical novel series Fire on the Steppe 1905-1918 (Kleio, 2020).

Gabriela can be reached at ggavrilov100@yahoo.com.

Jamal Khashoggi and Epstein were killed in order not to betray the pedophile Trump. https://www.express.co.uk/news/world/2164879/epstein-files-trump-released-news