[The article can be watched as a video here]

In their reporting on China, the Western mainstream media conjure up a massive real estate crisis, enormous youth unemployment and a severe economic crisis. But the collective West is harming itself with illusions about China’s economy, as you will see below.

“China is in the midst of a profound economic crisis,” Time magazine starts its most recent report on China.

Bad China news from Western media is nothing new. Last year and in prior years, there was a lot of bad news in the American media about the supposedly critical state of the Chinese economy.

It is not surprising that Washington’s European media partners are imitating the American doomsday scenarios about China.

The British neo-conservative, anti-China mouthpiece The Economist has been announcing one Chinese failure after another on its front cover for more than a decade.

Now the clamor about China’s alleged economic crisis has reached new heights in the Western media.

Against their better judgment, even Western correspondents based in China are spreading reports about China’s alleged major crisis. German journalist Matthias Kamp, Beijing correspondent for the leading Swiss newspaper NZZ, for example, reported that “restaurants and stores in Beijing are closing by the dozen,” using this example, which he did not substantiate, to illustrate the allegedly catastrophic state of the Chinese economy.

The title of his alarmist article was “China’s rulers are on high alert due to the economic crisis.” But when I looked around Shanghai recently, I found full restaurants and busy shops.

Contrary to the media, however, we should not take this as a sign of the health of the Chinese economy.

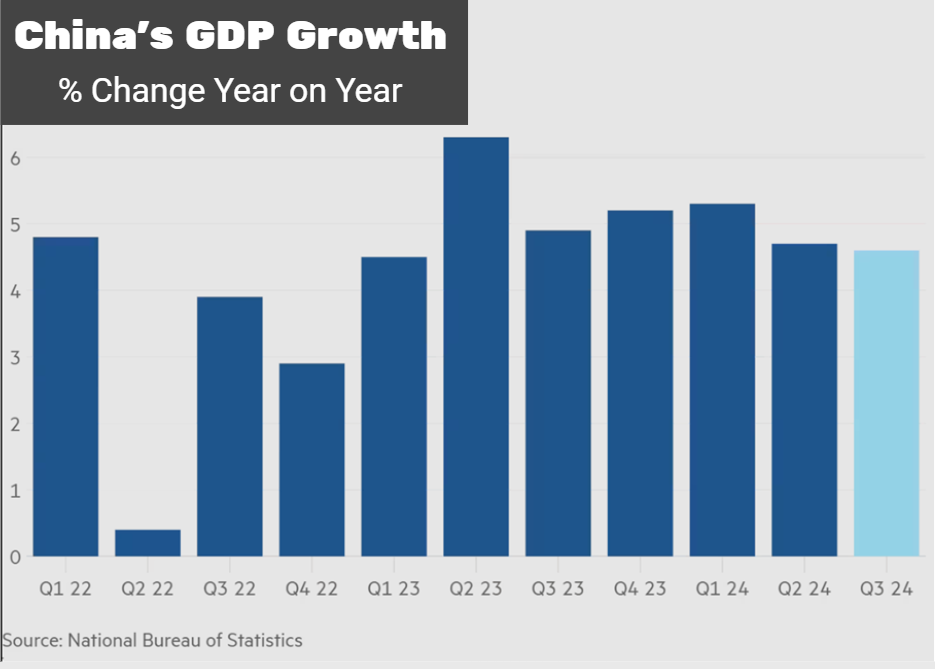

The situation in China is much more nuanced than the Western media portray it. Many Chinese are certainly disillusioned and disappointed that the partially saturated economy will have to make do with lower growth rates from now on. Chinese business people I have spoken to believe that citizens have become accustomed to very high annual growth rates over many years. However, it is completely absurd to talk about a general crisis because the economy is growing overall, with some sectors growing strongly and others, such as the real estate sector, stagnating or shrinking.

There is no doubt that the property sector, which was a driver of the economic boom for years, is in crisis. Since 2021, it no longer contributes anything to growth. This is shown in the following chart:

However, what the Western media deliberately overlook is that the real estate sector no longer plays a decisive role in the Chinese economy and no longer has the potential to drag the economy into the abyss. Nevertheless, it still influences consumer sentiment.

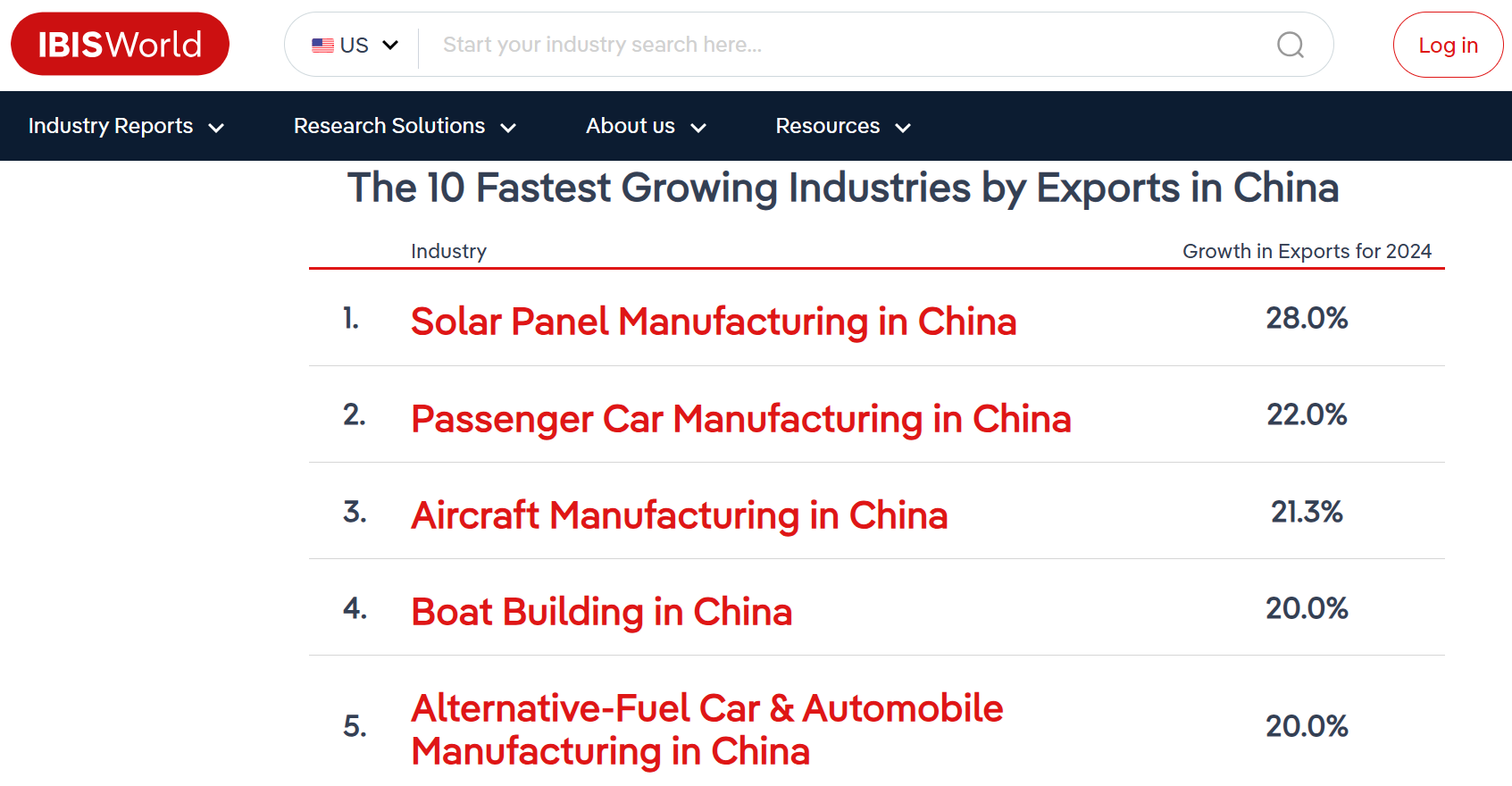

The industrial sector is booming all the more.

The five strongest sectors that are currently satisfying both rising domestic demand and foreign demand are: 1. solar module manufacturing; 2. car manufacturing; 3. aircraft manufacturing; 4. boat building; and 5. the construction of alternative fuel vehicles. These five sectors have also increased their exports by 20% to 28% this year.

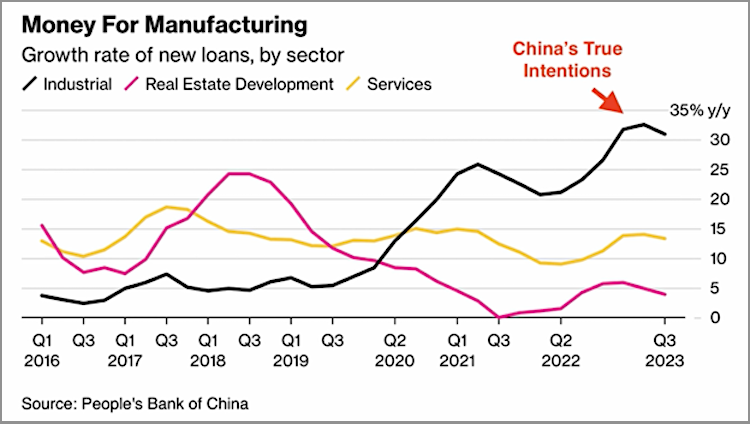

What you could not learn from the Western mainstream media is that Chinese bank lending for real estate peaked in 2018 and has been systematically reduced since then. In contrast, loans for productive sectors and industries of the future have been significantly expanded since 2019. This means that the economy has been steered away from the property zombie industry and toward growth industries via lending for the past five years.

Artificial intelligence is currently the fastest growing industry of the future: More than 237,000 AI companies were founded in China in the first six months of this year.

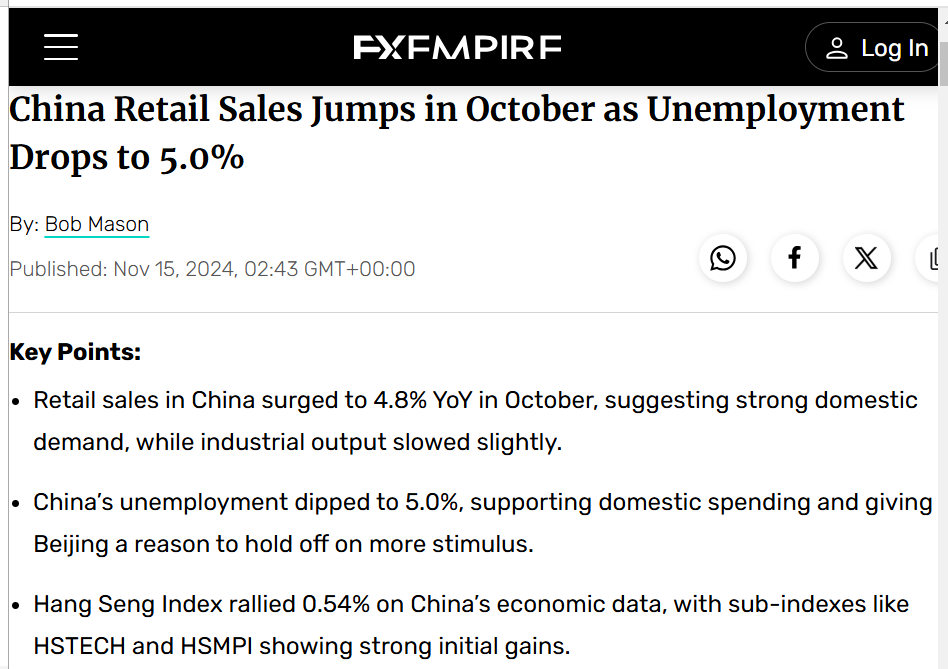

The government’s new stimulus packages are not an act of desperation, as the Western mainstream media would have us believe. In view of the intensified trade war that the U.S. and its allies want to wage with all their might against China, this is a necessary stimulus for domestic consumption.

My interlocutors among Chinese business people are convinced that this “transition phase,” in which dependence on Western markets will inevitably be reduced, will initially cost China a few painful percent of growth, especially if domestic demand is not strong enough to compensate for the losses on the export side.

China is focusing on its strategic strengths

In contrast to the West, where there is a lot of talk about an alleged economic crisis in China, China’s government does not think in terms of short-term economic cycles. Nor do companies think in terms of quarters and quarterly financial statements. An economy “with Chinese characteristics” means focusing on strategic strengths that will pay off in the long term. These will determine what China’s economic future will look like.

It is assumed that 64 critical technologies will determine the future of the world. China dominates 89% of them. Twenty years ago, the United States still dominated 60 of these 64 technologies. This is according to a report by the China-critical Australian Strategic Policy Institute, a think tank financially supported by the U.S. State Department and the U.S. military-industrial complex.

In recent decades, China has flooded almost the entire world with cheap industrial products. To achieve this success, Chinese companies initially copied Western technologies and applied them to mass production.

But many overlook that China has now mutated into the world’s leading research center. This is the only reason why China has been able to dominate the global economy in the fields of artificial intelligence, renewable energy, biotechnology, space technology and quantum computing.

Even The Economist now recognizes that China is a “scientific superpower.”

Supposedly “incapable of innovation”

Just ten years ago, the Harvard Business Review published a study claiming that China was incapable of innovation. Harvard researchers, looking at China through a clouded ideological lens, emphasized that “China is largely a land of rule-bound rote learners—a place where R&D is diligently pursued but breakthroughs are rare.”

They failed to recognize the Confucian character of the ruling party, which is more communist in name than in reality.

Only a decade after this damning finding, China had five times as many top research results as the United States.

While the U.S. was financing and waging overt and covert wars and overthrowing governments around the world, China was working behind the scenes and outperforming the U.S. in many areas.

To our great astonishment, however, the same Harvard Business Review recently concluded that China has created a sophisticated innovation ecosystem that “uniquely combines top-down government—industry coordination with the bottom-up drive of Chinese entrepreneurs.”

The authors point to the high economies of scale thanks to the huge consumer market as well as Chinas investments in the countries of the Global South, or more precisely Global Majority, which represent the growth markets of the future. However, it is also crucial that the toughest competition in the world prevails within China. Companies that survive this competition will be so strong that they will become global players and champions. The authors explain literally:

“Companies that survive the life-and-death struggles of China’s markets—often described as a ‘Gladiators Arena’—often emerge as global champions. Think of CATL (batteries), BYD (batteries and electric vehicles), Tongwei (solar), Goldwind (wind), or Huawei (information and communications technology).”

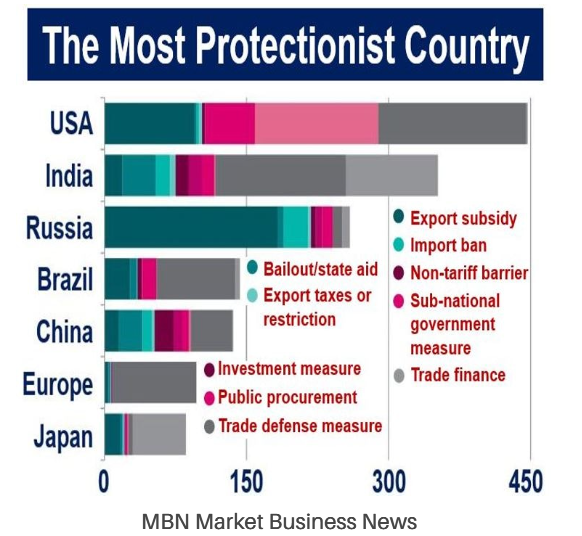

And how is the United States responding? The U.S. elite’s response to a highly innovative and superior competitor is to abolish the free market, which they championed as long as they dominated it, and resort to protectionism and coercive measures against China.

At the same time, Washington is intensifying its military encirclement of the country.

In addition, billions of U.S. taxpayer dollars are being spent on fear campaigns against the so-called “Chinese threat” when, in reality, it is China that is being threatened by the United States.

Fifteen years ago, Chinese consumers were still queuing up to pay cash for a Buick, Toyota, BMW, Audi or Mercedes. Today, most Chinese have switched to electric cars, especially Chinese cars, because they are now the market leader.

In addition to more advanced technology at lower prices, the U.S. economic war against China is also influencing Chinese buying behavior. (Watch my video: “Economic War Against China: Chinese Turn Nationalistic and Reject Foreign Brands” that explains why.)

Tesla, once the undisputed market leader in electric cars, which was able to charge premium prices, also felt the effects of the relentless Chinese competition. Despite four price cuts in China in 2023, the company was outperformed by its Chinese competition.

Will Chinese car manufacturers save their German competitors?

German car manufacturers were the first to teach the Chinese how to build cars with combustion engines. Now German engineers are learning from Chinese manufacturers how to build electric vehicles.

For example, Audi and the Chinese company FAW are working together on a $4.87 billion production plant for electric vehicles in China.

Innovation is expensive: China and the United States finance it very differently

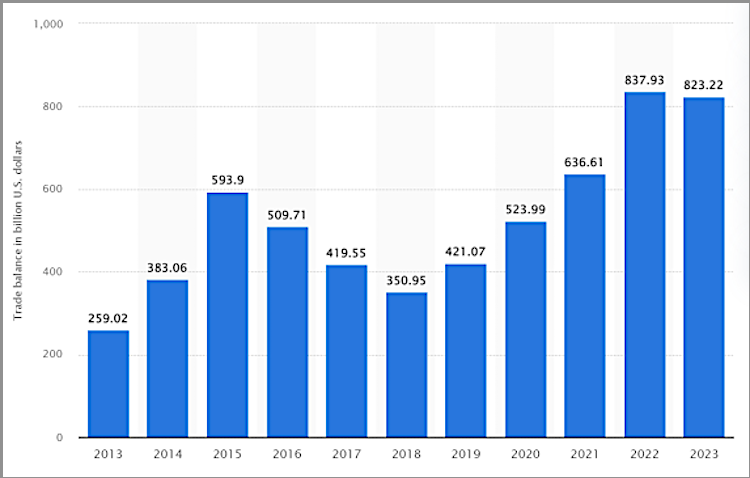

Last year, China had a trade surplus of $823 billion, exporting far more than it imported. The country is using its surplus income for research and development and to build critical industries, especially the key growth industries of the future. China promotes these through various incentives, regulations and centralized investment in scientific research.

While companies in the U.S. recognize that certain industries are the future, they are much slower to invest in them as they focus on maximizing immediate profits and are much less willing to invest for the long term.

In addition, the U.S. government plays a much smaller role in new industries than the Chinese government. And the priorities of the U.S. government can often change due to changing parties and budget priorities.

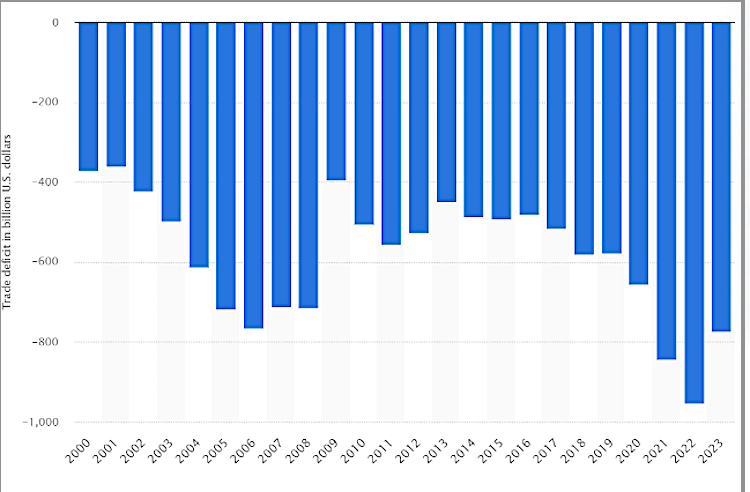

While China has a considerable trade surplus, the United States has a large trade deficit:

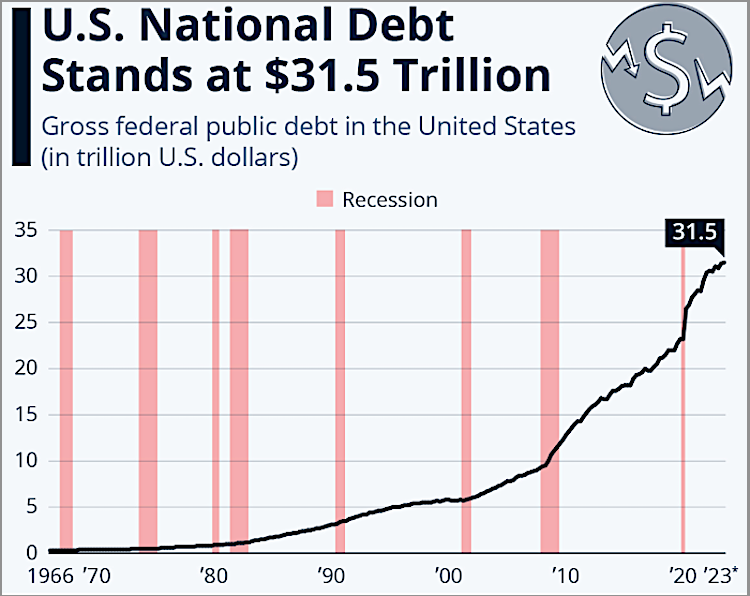

Due to the large U.S. trade deficit, any government funding must be raised by the Federal Reserve printing money, further driving up the debt of more than $31 trillion, increasing interest rates, fueling inflation and pushing the world further toward de-dollarization.

The large trade surplus and China’s “whole of nation” approach to innovation allows the country to mobilize almost unlimited government funds in addition to the enormous resources invested by private companies. From 1995 to 2021, China’s total spending on research and development rose from $18.2 billion to $620.1 billion, an increase of more than 3,300%! In the same period, spending on research and development in the U.S. rose by 277%.

In recent years, corporate profits and subsidies received in the United States—and in Europe too—have often been used to buy back shares and pay the salaries of top managers rather than for investment.

In the meantime, China has become a leading center for cutting-edge scientific research. The Economist admits that Chinese scientists are world leaders in high-profile publications and contributions to prestigious scientific journals, “selected through rigorous peer-review” processes.

No area illustrates China’s technological lead better than “Clean Tech.” Today, China accounts for more than 80% of global production capacity in eleven key clean-energy technologies. China dominates the rare-earth supply chain. It produces 70% of the world’s rare earths and processes 90% of all rare earths.

Western companies are finding it difficult to compete in the solar industry despite high customs barriers. Thanks to China’s enormous investments and the large domestic market, large solar panels cost barely 15% as much as they did in 2010.

It all began with bartering markets for know-how

After China opened up its economy in the 1970s, many Western companies moved to the country to take advantage of the huge market and cheap labor. In return for market access, Chinese companies benefited from decades of Western investment in traditional industries such as cars and chemicals.

This bartering, that is know-how in exchange for huge sales opportunities and profits, led to China’s reputation for “stealing technology.”

Ironically, it is now the West that is asking Chinese companies to come to their countries and share their expertise in critical technologies such as clean energy. One example is Invenergy, one of the largest U.S. renewable energy companies. As part of a 51/49 partnership with leading Chinese solar company LONGi, Invenergy opened the largest solar panel factory in the U.S. this year.

As part of this joint venture, Invenergy acquired LONGi’s advanced solar technology. The plant in Ohio is expected to produce 5 GW of solar modules annually and create more than a thousand new jobs.

Another example is the car company Ford, which recently announced a joint venture with CATL, China’s leading manufacturer of batteries for electric vehicles. The Americans are investing $3.5 billion in a new factory for electric car batteries in Michigan, which will use CATL technology for the cost-effective production of lithium-ion batteries for the Ford F-150 Lightning Truck and other electric cars.

The West neglected developing countries; China sees them as an opportunity

In the past, Western countries mainly exported their products to other high-income countries, often overlooking developing countries with smaller economies in the rest of the world. The Global South is home to 6.8 billion people, more than 85% of the world’s population.

And as their economies grow, so does their demand for goods and new technologies. China’s Belt and Road Initiative (BRI), for which China has invested more than a trillion dollars in over 150 countries, has led to the construction of major infrastructure such as ports, railroads and airports.

Unlike the U.S. and its Western allies, China does not interfere in the internal affairs of other countries. It is therefore not surprising that the supportive, non-patronizing China is much more popular there than the West. This helped, for example, that the majority of the smart-phone market in Africa is dominated by Chinese companies or that Huawei supplies 70% of the 4G network infrastructure in Africa.

In Latin America, the Chinese have a market share of 86% for electric vehicles and 40% of total car sales.

Standing up to the competition in the Chinese meritocracy or laying down your arms

Under the subtitle “The dangers of not being in China,” the Harvard Business Review now warns global companies not to make the mistake of not competing in China. Those which are not active in China risk “losing global revenues and strategic opportunities to their Chinese competitors.”

Little known in the West is the significant fact that the Tang Dynasty (618-907) introduced meritocracy, China’s revolutionary model of success that has endured to this day, as I explained in this article.

So, should we still believe the Western media and politicians when they say that the Chinese economy is doomed? Well, only if we want to be distracted from the fact that the economies of the United States and its allies are, booming, which is of course an illusion.

CovertAction Magazine is made possible by subscriptions, orders and donations from readers like you.

Blow the Whistle on U.S. Imperialism

Click the whistle and donate

When you donate to CovertAction Magazine, you are supporting investigative journalism. Your contributions go directly to supporting the development, production, editing, and dissemination of the Magazine.

CovertAction Magazine does not receive corporate or government sponsorship. Yet, we hold a steadfast commitment to providing compensation for writers, editorial and technical support. Your support helps facilitate this compensation as well as increase the caliber of this work.

Please make a donation by clicking on the donate logo above and enter the amount and your credit or debit card information.

CovertAction Institute, Inc. (CAI) is a 501(c)(3) non-profit organization and your gift is tax-deductible for federal income purposes. CAI’s tax-exempt ID number is 87-2461683.

We sincerely thank you for your support.

Disclaimer: The contents of this article are the sole responsibility of the author(s). CovertAction Institute, Inc. (CAI), including its Board of Directors (BD), Editorial Board (EB), Advisory Board (AB), staff, volunteers and its projects (including CovertAction Magazine) are not responsible for any inaccurate or incorrect statement in this article. This article also does not necessarily represent the views the BD, the EB, the AB, staff, volunteers, or any members of its projects.

Differing viewpoints: CAM publishes articles with differing viewpoints in an effort to nurture vibrant debate and thoughtful critical analysis. Feel free to comment on the articles in the comment section and/or send your letters to the Editors, which we will publish in the Letters column.

Copyrighted Material: This web site may contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. As a not-for-profit charitable organization incorporated in the State of New York, we are making such material available in an effort to advance the understanding of humanity’s problems and hopefully to help find solutions for those problems. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. You can read more about ‘fair use’ and US Copyright Law at the Legal Information Institute of Cornell Law School.

Republishing: CovertAction Magazine (CAM) grants permission to cross-post CAM articles on not-for-profit community internet sites as long as the source is acknowledged together with a hyperlink to the original CovertAction Magazine article. Also, kindly let us know at info@CovertActionMagazine.com. For publication of CAM articles in print or other forms including commercial internet sites, contact: info@CovertActionMagazine.com.

By using this site, you agree to these terms above.

About the Author

Felix Abt is the author of “A Capitalist in North Korea: My Seven Years in the Hermit Kingdom” and of “A Land of Prison Camps, Starving Slaves and Nuclear Bombs?”

He can be reached via his Twitter account.

China has the largest PPP (Purchasing Power Parity) in the world, an impressive 35.29 trillion dollars, which is actually relevant (instead of GDP, that is Gross Domestic Product). China is the largest economy when looking at PPP, a metric that takes into account price level differences between countries.

In 2023, China ranked 79th in the world in per capita purchasing power parity, with China’s per capita PPP at about $22,138.

In 2023, the United States ranked 10th in the world in PPP per capita. The per capita PPP for the United States was approximately $74,578.

While China has the largest PPP and the largest middle class in the world, the PPP per capita in the United States remains three to four times higher.

China therefore has considerable potential for economic expansion. Its trading partners, representing the majority of the world’s population (“Global South”), will have a significant stake in this expanding economic landscape, while the US and its vassals, unsuccessfully trying to weaken China, will be on the losing side.

More: https://felixabt.substack.com/p/chinas-economy-is-now-a-staggering

Robert Reich featured above is very critical of America’s economy with its large domination by large corporations and he he also extremely critical of mankind’s three biggest Dictators, Trump, Putin and Xi Ping as shown in this article that Robert Reich wrote>

https://www.theguardian.com/commentisfree/2022/apr/01/vladimir-putin-ukraine-truth-deniers-bad-decisions

China’s achievements are very big. Indeed it has the second largest GDP of any country in the world. Of course since China has five times as many people as the United States it ranks 116th in the world in GDP per Capita. China has many great accomplishments.